lincoln ne sales tax increase

The December 2020 total local sales tax rate was also 7250. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

Register Your New Business Online Nebraska Department Of Revenue

It was a close vote.

. You can print a 725 sales tax table here. This hotel is located in a city with a 175 city. This is the total of state county and city sales tax rates.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will. This included the statewide sales tax rate of 55 percent and the additional citywide rate of 15.

The group is asking the City Council to place on the April 9 primary. The push for raising the local sales tax in Lincoln started when a coalition of 27 community leaders were convened and met for months said Miki Esposito Lincolns public works director. The Nebraska state sales and use tax rate is 55 055.

The City of Lincoln today reminded residents that Lincolns sales and use tax rate will increase from 15 percent to 175 percent beginning October 1. You can print a 725 sales tax table here. Lincoln voters approved the 14-cent increase in April.

The Nebraska state sales and use tax rate is 55 055. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Elections Neighborhood streets are focus of.

The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax. The current total local sales tax rate in Lincoln NE is 7250. Lincoln Ne Sales Tax Increase.

There is no applicable county tax or special tax. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. What is the sales tax rate in Lincoln Nebraska.

There are sales tax rates for each state county and city here. The Lincoln City Council still has to vote on whether to ask voters to raise the sales tax to 175 percent. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

A coalition of community leaders today said a quarter-cent sale tax for streets is needed to keep Lincoln strong and growing. Leading up to the election the sales tax rate in Lincoln Nebraska was 7 percent. The lincoln city council still has to vote on whether to ask voters to raise the sales tax to 175 percent.

In April 2015 Lincoln voters approved a 14-cent increase from 15 to 175 in the City sales and use tax to support two important public. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect. Several local sales and use tax rate changes take effect in Nebraska on July 1 2019.

Lincoln is the capital city of the us. Coleridge Nehawka and Wauneta will each levy a new. Fix Lincoln Streets Now the coalition supporting the proposed quarter-cent sales tax increase has raised more than 200000 primarily from.

Lincolns City sales and use tax rate increase. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect. 025 lower than the maximum sales tax in NE.

Nebraska sales tax changes effective July 1 2019. The current state sales and.

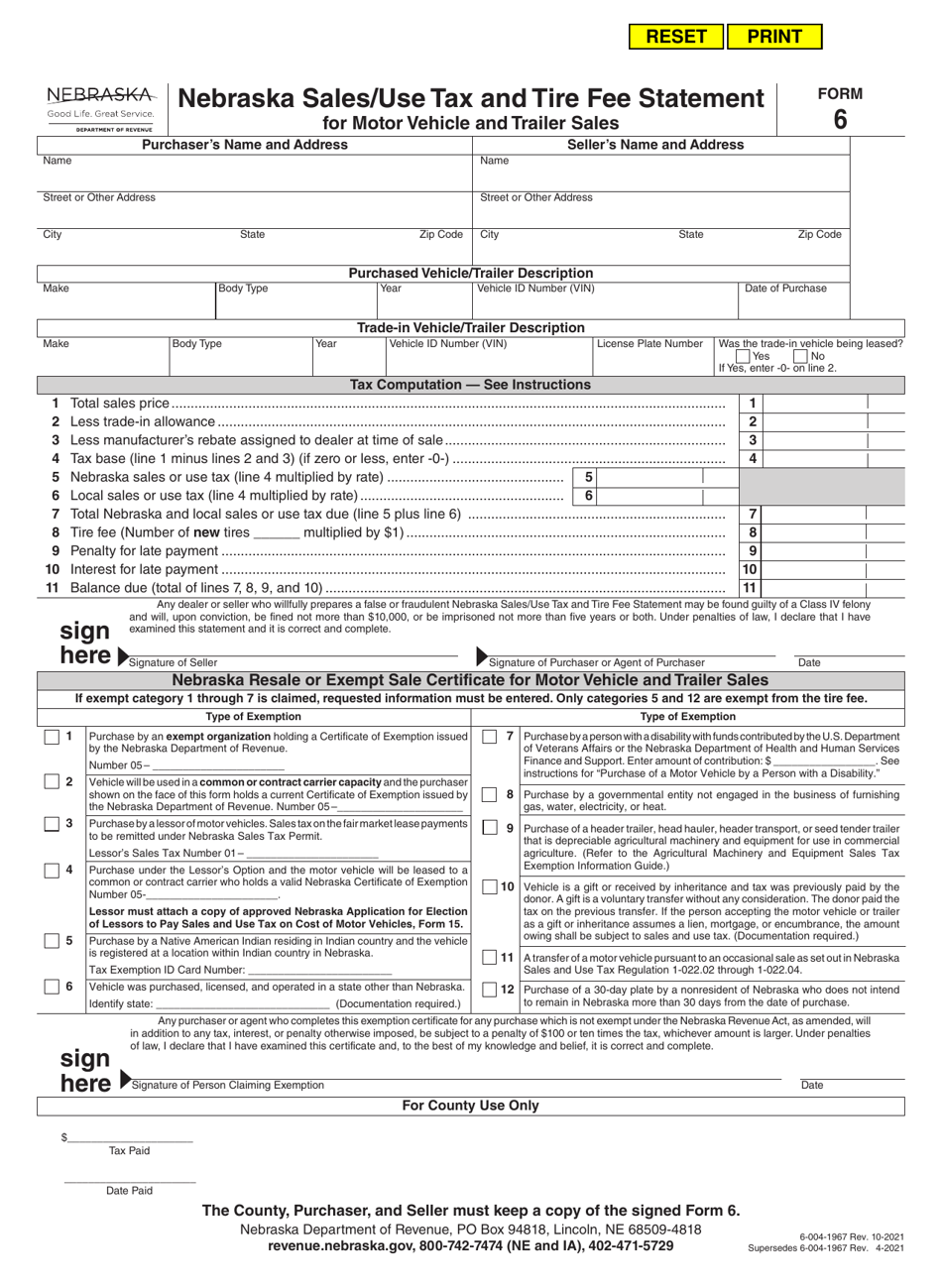

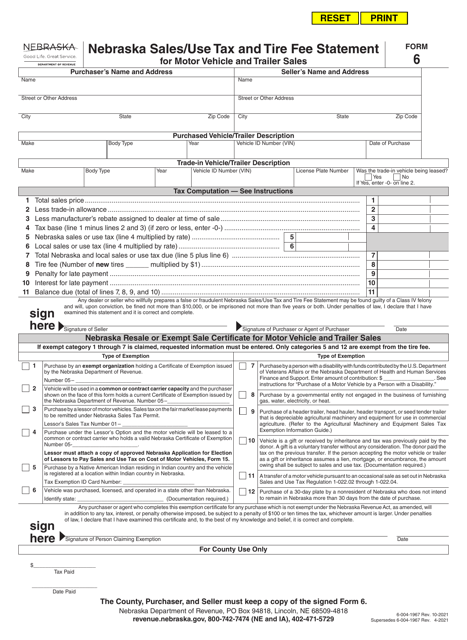

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

2022 What You Need To Know About Nebraska S Minimum Wage

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Nebraska State Tax Things To Know Credit Karma

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Illinois Doubled Gas Tax Grows A Little More July 1

Online Filing For Nebraska Business Taxes Nebraska Department Of Revenue

Nebraska Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Topped Out Lied Place Residences In Line For More Tif Money Local Business News Journalstar Com